Coal Power Finance in High-Impact Countries

Investment in new coal-fired power plants persists globally despite misalignment with a net-zero economy and the falling costs of renewable energy technologies.

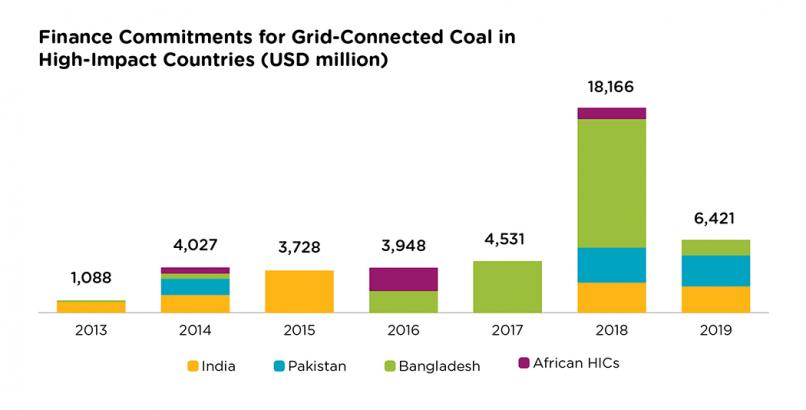

This knowledge brief, part of the Energizing Finance research series, highlights the political and economic dynamics underpinning recent investments in coal-fired power in 18 high-impact countries (HICs), defined as the countries with the highest absolute gaps in access to electricity. South Asian HICs Bangladesh, India and Pakistan have received the majority of finance commitments to new coal plants since 2013, and African HICs Madagascar, Mozambique, Malawi, Niger and Tanzania all host active coal plant development.

For the 18 HICs analysed, international public finance has comprised the highest proportion of finance committed to new coal-fired power plants since 2013.

This compares to renewable power plants, where nearly 60 percent of finance for new projects has been committed by domestic private investors in the same period. Financial institutions based in China account for 40 percent of the total USD 42 billion in finance committed to coal-fired power plants in HICs between 2013 and 2019. Though Chinese institutions are the largest coal investors in HICs, privately held financial institutions based in the US currently account for 58 percent of all investment in the global coal industry.

1 High-impact countries are defined in this analysis as reported in the Tracking SDG 7: The Energy Progress Report. This brief will focus on the 18 HICs in South Asia and Africa, which are Bangladesh, Pakistan and India in South Asia; Angola, Burkina Faso, Chad, DRC, Ethiopia, Kenya, Madagascar, Malawi, Mozambique, Niger, Nigeria, South Sudan, Sudan, Uganda and Tanzania in Sub-Saharan Africa. This analysis excludes Myanmar and North Korea given that the unique geopolitical and finance environments in those two countries present challenges to data availability.